Tennessee SNAP Income Limits: A Comprehensive Guide For 2023

Listen up, folks. If you're here, chances are you're trying to figure out how the Tennessee SNAP income limits work and whether you qualify for this essential program. SNAP, or the Supplemental Nutrition Assistance Program, is a lifeline for countless families across the U.S., and understanding its income guidelines is crucial. So, let’s break it down step by step, and I’ll make sure you leave here with all the answers you need. trust me, you’re in the right place.

Now, before we dive in, let’s clear the air. SNAP isn’t just some random program. It’s designed to help low-income individuals and families afford the food they need to live healthy lives. And in Tennessee, the income limits are specific, so it’s important to know exactly where you stand. We’ll cover everything from eligibility requirements to how to apply, and even some tips to maximize your benefits. Ready? Let’s go.

Oh, and one more thing—this guide is packed with the latest info, so you don’t have to worry about outdated rules messing up your plans. Whether you’re new to SNAP or you’ve been on it for a while, there’s always something to learn. Let’s get started!

- Acotar Cast The Rising Stars Of Shadow And Bone Who Stole Our Hearts

- Is Jess Still With Harry The Ultimate Guide To Their Relationship Drama

Table of Contents:

- What is SNAP?

- Tennessee SNAP Income Limits

- Eligibility Requirements

- How to Apply for SNAP

- Household Size and SNAP Benefits

- Asset Limits for SNAP

- Special Cases: Elderly and Disabled

- How to Calculate Your Income

- Frequently Asked Questions

- Useful Resources

What is SNAP?

First things first, let’s talk about SNAP itself. The Supplemental Nutrition Assistance Program is a federal initiative that provides financial assistance to buy food for eligible low-income individuals and families. Think of it as a safety net designed to ensure no one goes hungry. And yeah, it’s a big deal, especially in states like Tennessee where the cost of living can be tough for some folks.

SNAP operates through Electronic Benefits Transfer (EBT) cards, which work like debit cards at grocery stores. So, once you’re approved, you’ll get your benefits loaded onto this card every month. Easy peasy, right? But here’s the catch—you gotta meet certain criteria to qualify. And that’s where the Tennessee SNAP income limits come into play.

- Gfs Schaumburg Il The Ultimate Guide To Your Shopping Paradise

- Revolutionize Your Customer Support Why Ups Live Chat Is A Gamechanger

Now, don’t let the word "limits" scare you. These guidelines are in place to make sure the program helps those who need it most. And if you’re reading this, chances are you’re one of those people. Keep reading, and we’ll break it all down for you.

Tennessee SNAP Income Limits

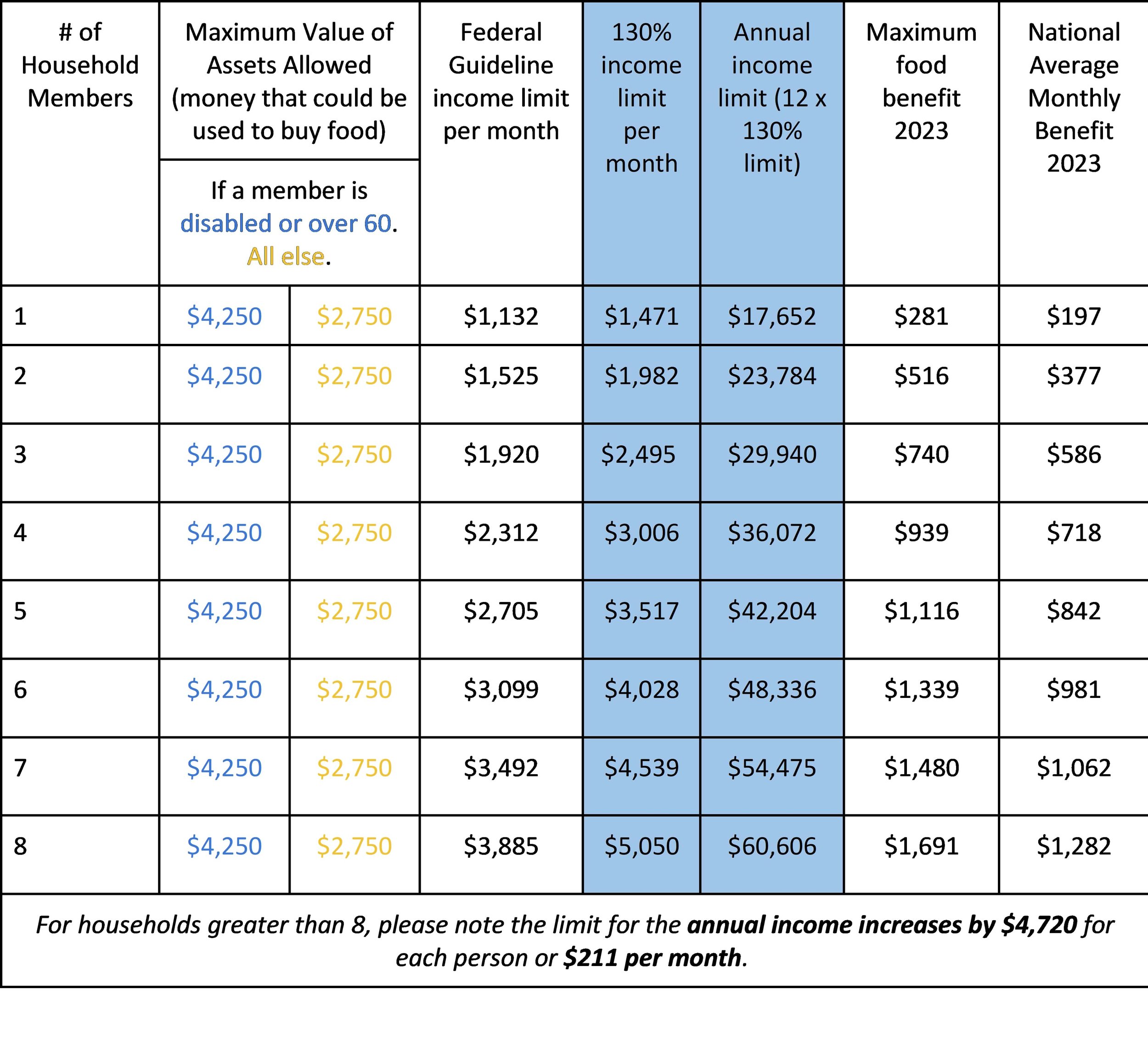

Alright, so here’s the deal. To qualify for SNAP in Tennessee, your household income must fall below a certain threshold. These limits are based on federal poverty guidelines and vary depending on the size of your household. For example, a single-person household has a different limit than a family of four.

As of 2023, the gross monthly income limit for a family of four is $3,568, which translates to about 130% of the federal poverty level. If you’re a single person, the limit drops to $973 per month. Now, these numbers might seem overwhelming, but stick with me—we’ll explain everything in detail.

And hey, don’t forget that net income also matters. This is the amount left after deductions, like childcare costs and medical expenses, are taken into account. So, even if your gross income is a bit high, you might still qualify if your net income is lower. Cool, right?

Breaking Down the Numbers

Let’s take a closer look at the income limits for different household sizes:

- Household of 1: $973 gross monthly income

- Household of 2: $1,316 gross monthly income

- Household of 3: $1,659 gross monthly income

- Household of 4: $1,992 gross monthly income

See how it works? The more people in your household, the higher the income limit. Makes sense, right? Because feeding more mouths costs more money.

Eligibility Requirements

So, we’ve talked about income limits, but that’s not the only thing that matters when it comes to SNAP eligibility. There are a few other boxes you need to check:

- You must be a U.S. citizen or a qualified non-citizen.

- You need to have a valid Social Security number.

- Most able-bodied adults without dependents (ABAWDs) must work or participate in a training program for at least 20 hours per week.

And here’s the kicker—if you’re unemployed and not actively seeking work, you might not qualify. But don’t worry, there are exceptions for certain groups, like the elderly and disabled. We’ll dive deeper into those later.

Special Considerations

Now, let’s talk about some special cases. If you’re over 60 or have a disability, the rules might be a little different for you. For example, elderly individuals and people with disabilities may qualify for higher asset limits and reduced work requirements. So, if this applies to you, make sure to mention it when you apply.

How to Apply for SNAP

Alright, so you think you might qualify. What’s next? Well, the application process is pretty straightforward. You can apply online through the Tennessee Department of Human Services (TDHS) website or by mailing in a paper application. Either way, you’ll need to provide some basic info, like:

- Your income and expenses

- Household size and composition

- Bank account balances and other assets

Once you submit your application, a caseworker will review it and schedule an interview. This can be done over the phone or in person, depending on your preference. And don’t worry—they’ll walk you through the whole thing.

Tips for a Smooth Application

Here are a few tips to make the application process as painless as possible:

- Gather all your documents beforehand. This includes pay stubs, bank statements, and any other financial info.

- Be honest and thorough in your answers. Any discrepancies could delay your approval.

- Follow up if you don’t hear back within 30 days. Sometimes things get lost in the system.

And remember, applying for SNAP isn’t something to be ashamed of. It’s a program designed to help people in need, and you deserve the support if you qualify.

Household Size and SNAP Benefits

Let’s talk about how household size affects your benefits. As I mentioned earlier, the income limits increase with the number of people in your household. But here’s the thing—the more people you have, the higher your benefits are likely to be.

For example, a family of four might receive around $680 in monthly benefits, while a single person might only get $213. Of course, these amounts can vary based on your specific circumstances, like your income and expenses. But the general rule is: more people, more benefits.

And if you’ve got kids or elderly family members in the mix, you might qualify for additional assistance. So, it’s always worth exploring all your options.

Calculating Your Benefits

So, how do they figure out how much you’ll get? It’s all based on your net income and household size. Here’s a quick breakdown:

- Your net income is calculated by subtracting allowable deductions from your gross income.

- Your benefits are then determined by comparing your net income to the maximum benefit for your household size.

Confusing? Yeah, a little. But don’t worry—your caseworker will handle all the math for you. All you have to do is provide accurate info.

Asset Limits for SNAP

Now, let’s talk about assets. While income is the main factor in determining SNAP eligibility, your assets also play a role. In Tennessee, most households can have up to $2,500 in countable resources, like bank accounts and property. For households with an elderly or disabled member, that limit increases to $3,750.

But here’s the good news—some assets don’t count against you. For example, your home and primary vehicle are usually exempt. So, if you’ve got a bit of savings or own a car, don’t panic. It’s all about the details.

What Counts as an Asset?

Here’s a quick list of what does and doesn’t count as an asset for SNAP purposes:

- Countable: Bank accounts, investment accounts, and certain types of property.

- Non-countable: Your home, primary vehicle, retirement accounts, and personal belongings.

See? Not as scary as it sounds. And if you’re still unsure, your caseworker can help clarify things.

Special Cases: Elderly and Disabled

Let’s talk about some special cases, like elderly individuals and people with disabilities. These groups often face unique challenges when it comes to accessing SNAP benefits. Luckily, there are some rules in place to make things easier for them.

For starters, elderly individuals and people with disabilities may qualify for higher asset limits. They might also be exempt from certain work requirements. And if they have high medical expenses, those can be deducted from their income, potentially increasing their benefits.

And here’s another perk—if you’re over 60 or have a disability, you might be eligible for expedited processing. This means you could receive your benefits faster than the standard 30-day waiting period. Pretty cool, right?

How to Apply as an Elderly or Disabled Person

If you fall into one of these categories, here’s what you need to do:

- Provide proof of age or disability when you apply.

- List any medical expenses that might affect your income.

- Request expedited processing if you need your benefits sooner.

And remember, you’re not alone. There are plenty of resources available to help you navigate the process.

How to Calculate Your Income

Alright, let’s get into the nitty-gritty of calculating your income. This is super important, because it determines whether you qualify for SNAP and how much you’ll receive. So, let’s break it down step by step:

- Start with your gross monthly income. This is your total income before taxes and deductions.

- Subtract allowable deductions, like childcare costs, medical expenses, and housing expenses.

- What’s left is your net income. This is the number that matters when determining your eligibility and benefit amount.

Still with me? Good. Because this is where the magic happens. By accurately calculating your net income, you can get a better idea of what to expect from SNAP.

Common Deductions

Here are some common deductions you might qualify for:

- Childcare costs

- Medical expenses for elderly or disabled household members

- Housing and utility expenses

- Dependent care costs

So, if you’ve got kids in daycare or high medical bills, make sure to include those in your calculations. Every little bit helps.

Frequently Asked Questions

Let’s wrap up with some common questions about Tennessee SNAP income limits:

- Can I apply if I’m unemployed? Yes, as long as you meet the other eligibility requirements.

- What if my income changes after I apply? You’ll need to report any changes in your income to your caseworker.

- Do I have to reapply every year? No, but you’ll need to recertify your eligibility periodically.

And if you’ve got more questions, don’t hesitate to reach out to the Tennessee Department

- Unveiling The Life Of Jefferson Whites Wife A Fascinating Journey

- In The Heart Of The Sea Movie Cast A Deep Dive Into The Story And Stars

What is SNAP? —

Food Stamp Guidelines 2025 Ny Cody Moresby

Schedule For Snap Benefits In Pa 2025 Mads L. Koch