California Tax And Fee: A Deep Dive Into What You Need To Know

Hey there, tax adventurer! If you're reading this, chances are you're either living in California, planning to move there, or just trying to figure out why everyone's talking about California tax and fee. Well, buckle up because we're about to take a wild ride through the world of Golden State finances. Whether you're a business owner, a homeowner, or just someone trying to understand their paycheck deductions, this is the ultimate guide for you. So, let's dive right in, shall we?

Let’s be honest, California tax and fee can feel like a maze sometimes. But don’t worry, we’ve got you covered. In this article, we’ll break down everything from sales tax to property fees, income tax, and even those pesky hidden charges that pop up when you least expect them. Think of this as your cheat sheet for navigating the financial landscape of California.

Now, before we get into the nitty-gritty, let’s set the stage. California is known for its sunshine, beaches, and world-class entertainment. But it’s also notorious for having one of the most complex tax systems in the country. Understanding California tax and fee isn’t just important—it’s essential if you want to keep more of your hard-earned money in your pocket. So, grab a coffee, and let’s get started!

- Chris Collinsworth Hands The Story Behind The Iconic Nfl Analysts Hands

- Unlock The Power Of Yamakas A Deep Dive Into Its Mysteries And Uses

Table of Contents

- What is California Tax and Fee?

- Sales Tax in California

- Income Tax Breakdown

- Property Tax Rates

- Fees You Should Know

- Hidden Charges and Surcharges

- Business Tax Overview

- Tax Credits You Can Use

- Filing Your Taxes

- Final Thoughts

What is California Tax and Fee?

Alright, let’s start with the basics. When we talk about California tax and fee, we’re referring to a wide range of financial obligations imposed by the state government. These include income tax, sales tax, property tax, excise tax, and various fees that apply to specific situations. It’s not just about paying Uncle Sam; California has its own set of rules that can make your head spin. But don’t panic—we’re here to simplify things for you.

California tax and fee are designed to fund public services like schools, roads, healthcare, and emergency services. While it’s true that the state offers some incredible benefits, the cost of living reflects that. Understanding how these taxes work is crucial if you want to budget effectively and avoid surprises.

Why Should You Care About California Tax?

Here’s the deal: California tax and fee directly impact your wallet. Whether you’re buying groceries, owning a home, or running a business, there’s a tax or fee lurking somewhere. For example, did you know that California has one of the highest sales tax rates in the country? Or that property taxes can vary significantly depending on where you live? These details matter, especially if you’re trying to make informed financial decisions.

- Taisho Era Japan A Time Of Transformation And Cultural Flourish

- H1b 2025 Results Your Ultimate Guide To Whatrsquos Ahead

Sales Tax in California

Let’s talk about one of the most common types of tax you’ll encounter in California—sales tax. The sales tax rate in California is a combination of state, county, and local taxes. As of 2023, the base state sales tax rate is 7.25%, but depending on where you shop, it can go up to 10% or even higher. Crazy, right?

Factors That Affect Sales Tax

Here are a few factors that influence how much sales tax you pay:

- Location: Different counties and cities have their own additional taxes.

- Type of Purchase: Some items, like groceries and prescription medications, are exempt from sales tax.

- Online Shopping: If you buy something online from an out-of-state retailer, you might still be subject to use tax.

Income Tax Breakdown

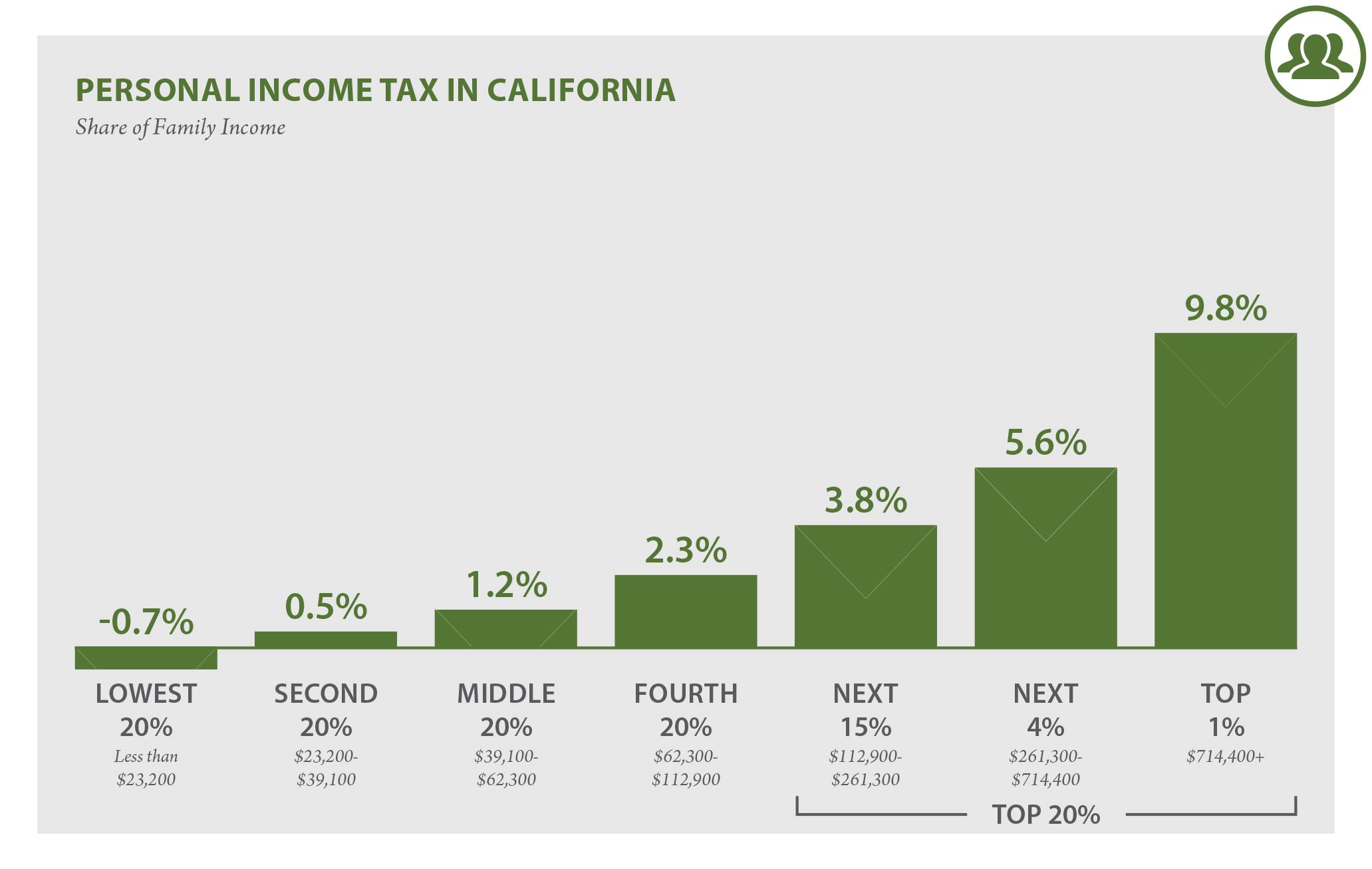

Now let’s shift gears and talk about income tax. California uses a progressive tax system, which means the more you earn, the higher the tax rate. In 2023, the income tax rates range from 1% for low-income individuals to a whopping 13.3% for high earners. Yikes! But don’t freak out just yet. There are ways to reduce your taxable income, which we’ll cover later.

Key Points About California Income Tax

Here are some important things to keep in mind:

- California has no standard deduction, but it does offer a personal exemption.

- You can itemize deductions if you have eligible expenses like mortgage interest or charitable contributions.

- California taxes capital gains at the same rate as regular income.

Property Tax Rates

Property tax is another big player in the California tax and fee game. Thanks to Proposition 13, property taxes are based on the assessed value of your home at the time of purchase, plus a small annual increase. Currently, the maximum property tax rate is 1% of the assessed value, but there may be additional fees for things like school bonds or special assessments.

How to Calculate Your Property Tax

Here’s a quick formula to help you estimate your property tax:

Assessed Value × Tax Rate = Property Tax

For example, if your home is assessed at $500,000 and the tax rate is 1%, your annual property tax would be $5,000. Easy peasy, right?

Fees You Should Know

Besides taxes, there are plenty of fees that come with living in California. These can include:

- Vehicle registration fees

- Business license fees

- Water and sewer fees

- Parking fines (because let’s face it, parking in California can be a nightmare)

While these fees might seem small individually, they can add up over time. That’s why it’s important to be aware of them and plan accordingly.

Hidden Fees to Watch Out For

Sometimes, fees can sneak up on you when you least expect them. For instance, did you know that some cities charge a hotel occupancy tax? Or that there’s a surcharge on restaurant bills for delivery services? These hidden fees can catch you off guard if you’re not paying attention.

Hidden Charges and Surcharges

Let’s talk about those sneaky little charges that show up on your bills. California is notorious for adding surcharges to everything from utility bills to credit card transactions. One common example is the Public Purpose Program (PPP) charge on electricity bills, which funds renewable energy initiatives. Another is the Telecommunications Gross Receipts Tax, which applies to phone services.

How to Spot Hidden Charges

Here’s how you can stay vigilant:

- Read your bills carefully and look for unfamiliar charges.

- Ask your service provider for clarification if something seems off.

- Keep track of any changes in rates or fees over time.

Business Tax Overview

If you’re a business owner in California, you’ll need to familiarize yourself with the various taxes and fees that apply to your operations. Some of the main ones include:

- Corporate income tax

- Sales and use tax

- Employment training tax

- Franchise tax

Each of these taxes has its own set of rules and deadlines, so it’s crucial to stay organized and seek professional advice if needed.

Tips for Business Owners

Here are a few tips to help you navigate the business tax landscape:

- Keep detailed records of all your expenses and income.

- Take advantage of available tax credits and deductions.

- Consider hiring a tax professional to ensure compliance.

Tax Credits You Can Use

Now for the good news! California offers several tax credits that can help reduce your tax liability. Some of the most popular ones include:

- California Earned Income Tax Credit (CalEITC)

- Dependent Care Credit

- Disaster Loss Credit

These credits are designed to provide relief to taxpayers who meet certain criteria. Be sure to check if you qualify for any of them when filing your taxes.

Filing Your Taxes

When it comes to filing your California taxes, there are a few things to keep in mind. First, make sure you have all the necessary documents, such as your W-2 forms, 1099s, and any receipts for deductible expenses. Next, decide whether you want to file electronically or by mail. E-filing is usually faster and more convenient, but some people prefer the old-school method.

Common Mistakes to Avoid

Here are a few common mistakes to watch out for:

- Missing deadlines: The California tax deadline typically aligns with the federal deadline, but double-check to be sure.

- Forgetting to claim credits: Don’t leave money on the table if you’re eligible for tax credits.

- Miscalculating deductions: Double-check your math to avoid errors.

Final Thoughts

And there you have it—a comprehensive guide to California tax and fee. While it may seem overwhelming at first, understanding how these taxes work can help you make smarter financial decisions. Whether you’re dealing with sales tax, income tax, or property tax, always remember that knowledge is power. And hey, if all else fails, there’s no shame in seeking professional help.

So, what’s next? We encourage you to share this article with anyone who could benefit from it. And if you have any questions or thoughts, feel free to drop a comment below. Together, let’s conquer the world of California taxes and fees one step at a time. Cheers to saving more of your hard-earned cash!

- 27 Celebrities Who Died Remembering The Stars Weve Lost

- Letty Fast And Furious The Ultimate Guide To Her Journey Legacy And Impact

Tax Rate By California at Curtis Rall blog

How much are you paying in taxes and fees for gasoline in California

Tax guide Best city to buy legal weed in California Leafly